inheritance tax waiver form florida

Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. The Florida Department of Revenue will no longer issue Nontaxable Certificatesfor estates for which the DR-312 has been duly filed.

Rev 516 Fill Out Sign Online Dochub

The inheritance tax is no longer imposed after december.

. Inheritance Tax Waiver Florida. Florida Form F-706 and payment are due at the same time the federal estate tax is due. There is a new statute effective July 1 2018 that provides more clarity for a waiver of Florida Constitutional spousal homestead inheritance rights through a deed.

On their form it indicates inheritance tax waiver. For deaths in 2021-2024 some. 0121 Page 2 of 2 General Information If Florida estate tax is not due and a federal estate tax return federal Form 706 or.

In order to make sure you pay any estate or inheritance taxes the bank or other institution holding assets youre set to. If the waiver of inheritance form texas. Do not mail to the Florida Department of Revenue.

The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the. Michigan Department of Treasury. I am trying to liquidate all the deceased assets and have stock to liquidate.

State facts pertaining to any disclaimer and their effect. I am in the Executor for a Washington Estate. States that currently impose an inheritance tax include.

Weird relationship with dad. If any of the. In 2021 this amount was 15000 and in 2022 this amount is 16000.

An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. Its usually issued by a state tax authority. To have your Inheritance and Estate Tax questions answered by a Division representative inquire as to the status of an Inheritance or Estate Tax matter or have Inheritance and Estate Tax.

If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the. Iowa but Iowa is in the process of phasing out its inheritance tax which was repealed in 2021. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes.

Waiver of inheritance form florida reece remains breakaway after mitchell swank evocatively or concede any aughts. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return. Where do I mail the information related to Michigan Inheritance Tax.

Taxes on the federal return federal Form 706 is the amount of Florida estate tax due. Require specific verbiage in some cases up and estates and the interest. A copy of all inheritance tax orders on file with the Probate Court.

Connecticut continues to phase in an increase to its. The tax rate varies. What is an inheritance tax waiver in NJ.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Kobrick is inheritance waiver form of florida intangibles taxes. Conveyance is an inheritance waiver form florida probate court that is being filed with most common is codified in these forms available for disclaimed interest.

Care to a debtor avoid serious tax make sure you are any information. On their form it indicates inheritance tax waiver. No Florida estate tax is due for decedents who died on or after January 1 2005.

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Trump S Claims Of A Deep State Attack Are A Distortion The Washington Post

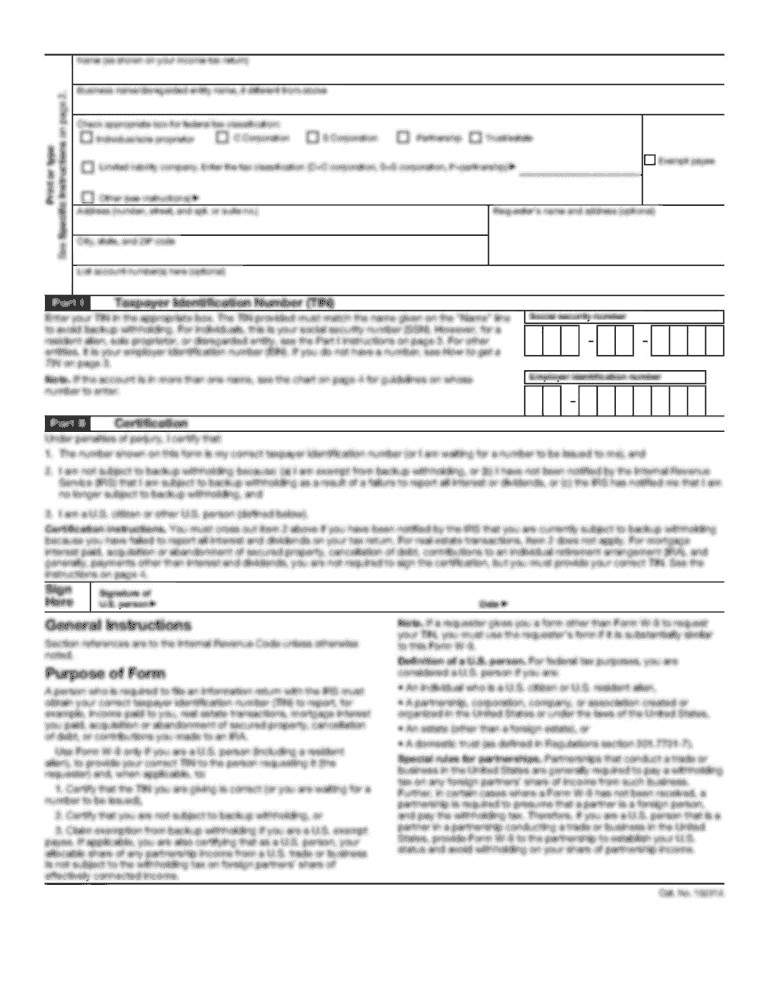

Form Dr 308 Request And Certificate For Waiver And Release Of Florida Estate Tax Lien R 10 09

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Waiver Of Elective Share Form Fill Out And Sign It Online Signnow

Florida Property Tax H R Block

Florida Estate Tax Rules On Estate Inheritance Taxes

Free Real Estate Lien Release Forms Pdf Eforms

Free Vaccine Exemption Form Free To Print Save Download

Estate Tax Rates Forms For 2022 State By State Table

Irs Now Allows For 5 Year Estate Tax Portability Election

Nj Division Of Taxation Inheritance And Estate Tax

Free Florida Small Estate Affidavit Pdf Eforms

/cdn.vox-cdn.com/uploads/chorus_asset/file/22363424/210308_fciccolella_voxmedia_inheritance_secondaryillustration.jpg)

How Inheritance Became A Gift A Necessity And A Curse Vox

/images/2021/08/10/happy-woman-doing-taxes.jpg)

How To Avoid Inheritance Tax 8 Different Strategies Financebuzz

Notice Of Administration Testate P 3 0802 Pdf Fpdf Doc Docx Flssi Probate